Companies both large and small can benefit from fresh thinking. For newer companies that rely on digital and direct marketing to acquire new customers, fresh thinking can be particularly powerful in areas such as branding, analytics, and marketing management.

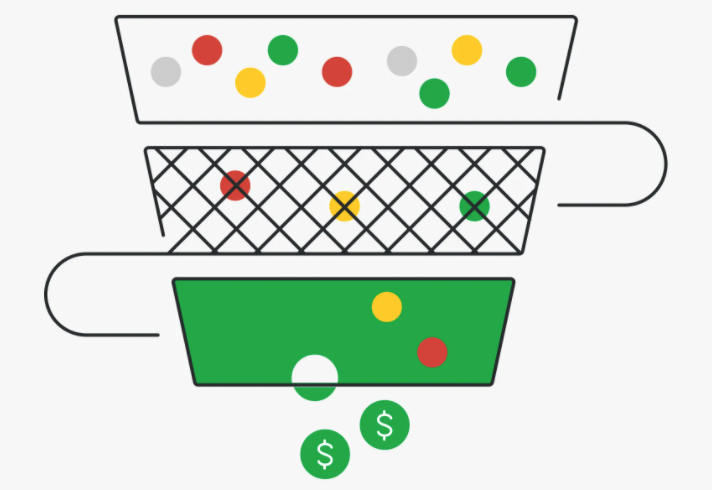

Don’t Forget About Your Internal Lead Funnel!

In many organizations the work of marketing stops after a lead is generated. Money has been invested to generate responses and marketers have a clear understanding of their Cost Per … Read More

The Value of Customer Lifetime Value

How much can you afford to spend to acquire a new customer? It all depends on how much value a new customer generates for your organization. Some companies have very … Read More